What is a 1099-K?

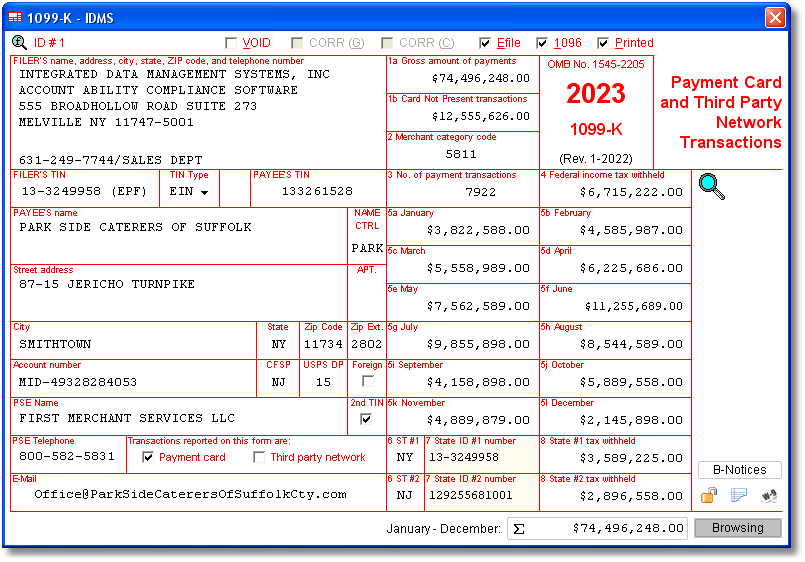

The 1099-K form is like a report card from payment processors (think PayPal, Stripe, Square) to the IRS. It shows the total amount of transactions you processed through them during the year. This form doesn’t just cover sales; it includes refunds, credits, and anything else that passed through their system. The idea is to give the IRS a clearer picture of the electronic transactions businesses are handling.

Why the Delay in Full Implementation?

The IRS planned to lower the reporting threshold for 1099-K from $20,000 and 200 transactions to just $600 with no minimum transaction count. This change was set to kick in for the 2022 tax year. But there’s been a bit of a hold-up, and here’s why:

- Feedback and Pushback: Small business owners and their advocates raised concerns. They worried about the paperwork and confusion this change would bring, especially for those who aren’t deep into tax details.

- Technical and Operational Challenges: Implementing such a significant change isn’t just about updating a form. It involves a lot of backend work for payment processors and the IRS. They need time to get their systems and processes aligned.

- Need for Clarity: There’s been some confusion over what exactly needs to be reported. For instance, if you sell a couch on eBay, does that count? The IRS needs to provide clear guidelines so people know what to report.

Will You Need to Report More Transactions?

As a small business owner, here’s what you should keep an eye on:

- If the Change Happens: If the threshold does drop to $600, it means more of your transactions will likely be reportable. This change mainly affects those who use electronic payment platforms a lot, even for smaller transactions.

- Nature of Transactions: It’s not just about how much money you’re making but also how you’re making it. If you’re running a business and using platforms like PayPal, expect these transactions to be reported to the IRS.

- Personal vs. Business: The tricky part is differentiating between personal and business transactions. Say you sold your old laptop on eBay; that’s personal. But if you’re regularly selling items or services as part of a business, that’s what the IRS is interested in.

In short, keep an eye on IRS updates and chat with a tax pro if things get too confusing. The latest November 21, 2023 IRS news release provides further details on what the IRS plans are for future implementation of 1099-K reporting.

Summary of IRS News Release of November 21, 2023

Read the full news release here.

Delay in New Form 1099-K Reporting Threshold

- Initial Plan: The IRS planned to lower the reporting threshold for Form 1099-K to $600 for third-party settlement organizations (TPSOs) in 2023.

- Feedback Led to Delay: Due to concerns from taxpayers and tax professionals, the IRS has decided to delay this change.

2023 as a Transition Year

- Current Threshold Maintained: For 2023, the old threshold remains in effect. TPSOs will only need to issue Form 1099-K if a taxpayer exceeds $20,000 in transactions and has more than 200 transactions.

- Reason for Delay: This delay is meant to reduce confusion and prevent issuing 44 million Forms 1099-K to those not expecting them or without tax obligations.

Future Plans

- 2024 Phase-In: The IRS proposes a $5,000 threshold for 2024, as a step towards implementing the $600 threshold.

- Form 1040 Updates: The IRS plans to update Form 1040 and related schedules to simplify reporting for taxpayers in 2024.

Commissioner’s Statement

- Need for More Time: IRS Commissioner Danny Werfel emphasized the need for additional time to effectively implement these changes and prevent confusion.

Exclusions from the Requirement

- Personal Transactions: The reporting requirement does not apply to personal transactions like gifts or sharing costs.

- Casual Sales: Selling personal items at a loss may still trigger a Form 1099-K, even if there’s no tax liability.

IRS’s Approach

- Seeking Feedback: The IRS is open to feedback, especially on the proposed $5,000 threshold for 2024.

- Focus on Compliance: The aim is to ensure compliance with the law while minimizing taxpayer burden.

- Future Reporting: The IRS recognizes the importance of careful expansion of reporting requirements to ensure accurate issuance of Form 1099-K.

Additional Resources

- Further Information: The IRS will continue providing updates and information on IRS.gov/1099k.